Guide to capital gains tax for landlords

You pay Capital Gains Tax when selling a property in the UK. Learn about rates for buy-to-let properties, what tax reliefs are available for landlords and more.

Jale

If you’re a landlord in the UK looking to sell your buy-to-let property, then it’s essential to understand the implications of Capital Gains Tax (CGT).

In this article, we'll talk about

- The basics of Capital Gains Tax

- How it applies to buy-to-let properties

- When and how to pay it

- Which reliefs you can benefit from

Let’s dive in!

What is Capital Gains Tax?

Capital Gains Tax is a tax you must pay on the profit you make from selling a property, asset or investment that has increased in value since you bought it.

As a landlord, you’ve to pay CGT when you sell or transfer ownership of a rental property, second home, or any property that isn't your main residence.

Who is exempt from Capital Gains Tax on property in the UK?

Homeowners selling their main residence don’t have to pay Capital Gains Tax.

The only exception applies to live-in landlords. Landlords are still obligated to pay CGT when they sell their main residence if they let out a vacant room in their property. But the tax amount will be reduced. More about this later.

How to calculate Capital Gains Tax in the UK

You pay Capital Gains Tax on the value increase of the asset you’ve sold, not on the total amount you received from the sale.

To determine how much Capital Gains Tax you owe when you sell a property, you subtract the cost of buying the property (including buying expenses) from the money you receive from selling it (after deducting selling expenses). The amount left over is the chargeable gain,, and that's what you'll be taxed on at the current CGT rates.

You’ll only pay CGT on your total chargeable gain above an annual tax-free allowance. The annual Capital Gains tax-free allowance in 2023 is £6,000.

How much is Capital Gains Tax on property?

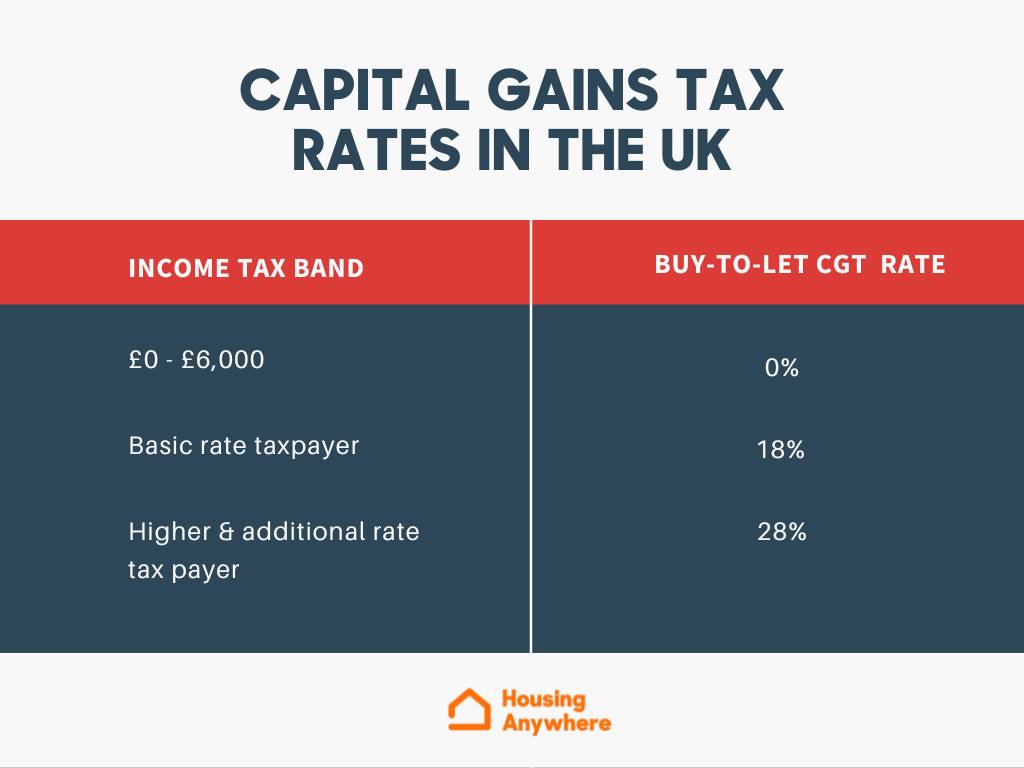

Capital Gains Tax rates for buy-to-let properties in the UK depend on your overall income tax band and the type of property you’re selling.

Here are the current CGT rates specifically applicable to residential buy-to-let properties depending on the Income Tax band:

Non-UK resident landlords must pay a flat rate of 10% for basic rate taxpayers and 20% for higher and additional rate taxpayers.

Reporting capital gains

You must report the sale of the property to HMRC within 60 days from the date of completion (when the sale is finalised) if:

- Your total gains are more than the annual tax-free allowance or,

- The price of the property you sold was more than a threshold (£50,000 for 2023/24)

There’re 2 ways you can report:

- Using an online service. You’ll need a user ID and password to access the system. You can create an account when you report if you don't already have these.

- Filling out a paper form and sending it by post.

In addition to reporting to HMRC, you’ll also need to provide details of any capital gains you’ve made at the end of the relevant tax year on your income tax return.

Depending on how you file your income tax return, you can either:

- Report capital gains online using the capital gains section of the online Self Assessment form or,

- Send it by post filling out a supplementary paper form for Capital Gains alongside your main tax report.

Non-resident landlords must report sales of UK property even if they have no tax to pay or have made a loss.

What records do you need to keep for CGT?

You need to collect and keep relevant records to calculate your gains and complete your tax return accurately.

The records you’ll need to keep are as follows:

- Purchase and sale documents (receipt of the purchase, selling contract, etc.).

- Documents related to rental activities (rental contracts, rent payments, mortgage interest statements, etc.).

- Supporting documentation for relief.

- Receipts of any additional costs like fees for professional advice, Stamp Duty and improvement costs.

- Documents supporting the market value evaluation.

You must keep these documents for at least a year after the Self Assessment deadline in case HMRC has any questions for you.

How to pay your Capital Gains Tax

You’ve to pay your Capital Gains tax within 60 days from the date of completion.

You can pay your Capital Gains Tax online if you choose the online option to report your CGT.

If you choose to report by paper form, you have to wait for HMRC to send you a payment reference with the following information:

- 14-digit payment reference starting with X

- Your payment date

- Information on how to pay

HMRC may take several weeks to send you a payment reference. And since paying the CGT without payment reference is impossible, we advise you to use an online service to ensure you pay on time.

What are the buy-to-let Capital Gains Tax reliefs?

If the property was your main residence at any point before or while you let it out, you could qualify for tax relief to reduce your CGT bill. This also applies to live-in landlords who let out a vacant room in their home. Let’s look at it case by case.

1. If you let out your entire home

You’ll receive Private Residence Relief (PRR) tax relief for the years when the property was your main residence and the last 9 months leading up to the sale. Those periods will be exempt from Capital Gains Tax.

Let’s look at an example.

Assume you bought a property in January 2016 for £200,000 and sold it in January 2020 for £250,000. Your capital gain from the sale is £50,000. It was your main residence for the first 2 years (24 months), and you let it out for the remaining 2 years. In this case, you’d be entitled to relief covering 31 months (24 months you lived there plus the final 9 months before the sale) out of the 48 months. That relief would equal £32,292 – calculated as (£50,000/48 months) x 31 months. So you’d be taxed only on £17,708 of the capital gain.

2. If you only let out part of your home

If you lived in your home simultaneously with your tenant, you’d receive Private Residence Relief only on the proportion of the home you lived in. But you might also be entitled to a further relief known as Lettings Relief.

To be eligible for Lettings Relief: 1. The property you sell must be your only or main residence. 2. The property must be your main residence while you let part of it.

Lettings Relief covers any proportion of the chargeable gain you make while you let out part of your home. With Lettings Relief, you can get the lowest of the following:

- The amount of Private Residence Relief you are eligible for.

- The gain attributable to the let portion of the property.

- £40,000 (the maximum Letting Relief amount).

Let’s look at an example.

Assume you sold your property and made a chargeable gain of £100,000. Throughout your ownership period, you let out a bedroom that comprised 35% of the property. As you didn’t occupy the whole property as your main residence, you only get Private Residence Relief for £65,000 (65% of £100,000). The chargeable gain attributable to the letting is the remaining gain of £35,000.

In addition to PRR, you’re also entitled to lettings relief based on the lesser of 3 amounts.

- £65,000 (the Private Residence Relief)

- £35,000 (the chargeable gain attributable to letting)

- £40,000 In this case, the lowest Letting Relief you can receive is £35,000. As a result, you won’t pay any CGT.

How to reduce your Capital Gains Tax bill

Apart from CGT reliefs, you can reduce your tax liability in other ways.

1. Property with multiple owners: If you jointly own a property with other individuals, each owner is entitled to their own CGT allowance. This means that the tax-free allowance is effectively multiplied by the number of owners, reducing the overall taxable amount.

2. Property improvements: If you’ve made improvements to the property and haven't claimed them as allowable expenses, you can deduct them from the overall gain when calculating CGT.

3. Buying and selling fees: As we already mentioned, certain fees associated with the acquisition and sale of the property are factored into the CGT calculation. This includes expenses such as legal fees, estate agent fees, and surveyor fees. Deducting these costs from the overall gain will reduce the taxable amount and decrease your CGT liability.

It's important to consult with a qualified tax professional or seek advice from HM Revenue and Customs (HMRC) to ensure you fully understand and comply with the relevant tax regulations when applying these strategies to reduce your CGT bill.

This article is for informational purposes only. Please consult the appropriate authorities for the latest developments or a lawyer for legal advice.

For feedback on this article or other suggestions, please email content@housinganywhere.com

Related articles

In this article

Find trustworthy tenants from the comfort of your couch.

Chat with tenants and ask for documents to verify their identity. You get the final say in who moves in.

Start safe tenant search